Fiscalization Error codes (English)

Documentation Menu

Newsletter Subscription

Fiscalization Error codes (English)

Fiscalization errors – explanation

For proper interpretation of fiscalization messages, it is important to understand the role of MER in the exchange and to distinguish between outgoing and incoming fiscalization.

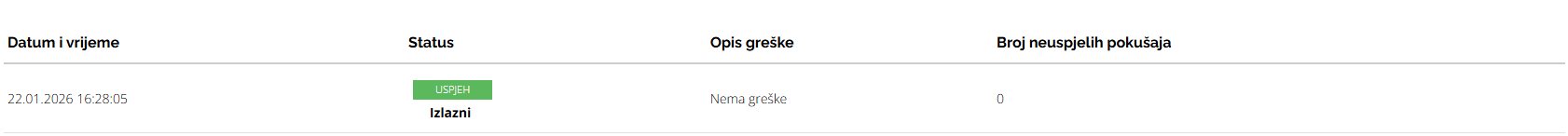

– If MER is the sender’s access point, the user sees only the outgoing fiscalization message. In this case, the outgoing status is relevant for determining whether the invoice has been fiscalized. If the outgoing fiscalization is successful, the invoice is considered successfully fiscalized.

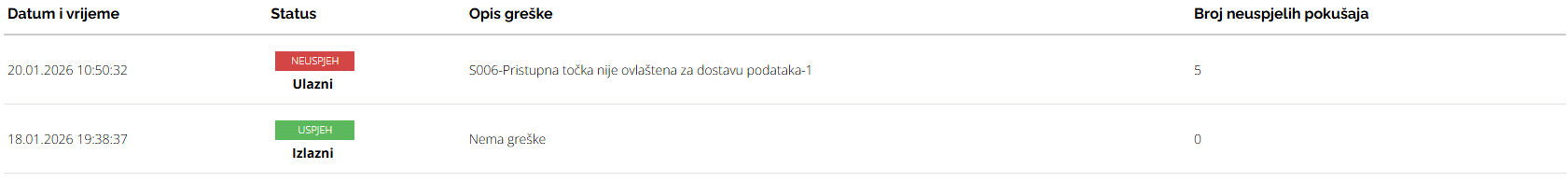

– If MER is the recipient’s information intermediary and the sender uses a different access point, the user sees only the incoming fiscalization message. The fiscalization status is then monitored exclusively based on the incoming message and used to determine whether the document has been fiscalized.

– If MER is the information intermediary for both the sender and the recipient, both the outgoing and incoming fiscalization messages are visible. In this case, fiscalization statuses may exist on both sides.

– If both outgoing and incoming fiscalization messages are visible, but only one side is successful, it is necessary to primarily check the fiscalization status on your own side:

Fiscalization status can be checked via:

a) MER Service – Sent documents → Document details

S001 – System error during request processing

The error is on the MER system side. Fiscalization will be automatically retried during a period of 5 days from document submission.

S002 – Invalid signature location

The error is on the MER system side. Fiscalization will be automatically retried during a period of 5 days from document submission.

S003 – Certificate was not issued by a trusted service provider, has expired, or has been revoked

The error is on the MER system side. Fiscalization will be automatically retried during a period of 5 days from document submission.

S004 – Invalid request signature

The error is on the MER system side. Fiscalization will be automatically retried during a period of 5 days from document submission.

S005 – Message is not compliant with the XML schema: one or more elements are invalid

The error is related to the XML document structure. The XML did not comply with the UBL 2.1 schema. It is necessary to check the XSD schema available on our XML documentation page, compare the element order, and use the available XML examples to ensure the correct format.

S006 – Access point is not authorized to submit data

The sender or recipient selected an access point that is not authorized to perform invoice fiscalization in the ePorezna system. It is necessary to grant authorization in the ePorezna system. If the invoice has already been fiscalized on your side, no additional steps are required.

S007 – The OIB in the request is not formally valid

This error can occur in the following cases: – The OIB is invalid – verify the correctness of the OIB – The OIB contains blank spaces or does not consist of exactly 11 digits – EndpointID and PartyIdentificationID must not contain the HR prefix – The operator’s OIB must be a valid 11-digit OIB

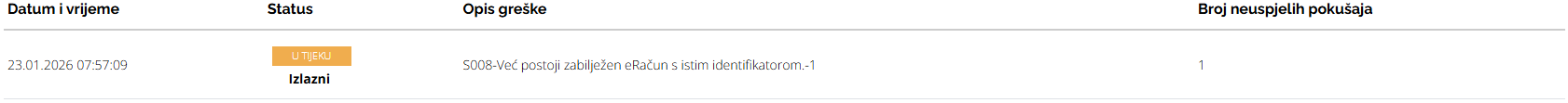

S008 – An eInvoice with the same identifier already exists

The sender is attempting to send an invoice with a number that has already been fiscalized. If an invoice with that number is not visible in the MER service, it is necessary to check in the ePorezna system whether the invoice has already been sent via another access point. When correcting a fiscalized invoice: – if amounts are changed, a storno (credit note) must be issued – if general invoice information is changed, a new invoice must be sent with the same invoice number and the CopyIndicator flag

S009 – The eInvoice does not exist

This error occurs when sending a storno, rejection, or payment notification for an invoice that has not been fiscalized or does not exist in the system. Verify whether the invoice with the specified identifier is visible and fiscalized in the system.

S010 – A rejection status for an eInvoice with the same identifier already exists

A rejection status with the same identifier already exists. It is necessary to verify the rejection status in the ePorezna system.

S011 – Unknown error

An error occurred that cannot be uniquely classified. It is recommended to retry sending the document or contact support if the error persists.

S012 – The original eInvoice for which the corrective invoice was submitted does not exist

This error occurs when sending an invoice with CopyIndicator for which there is no visible fiscalized original invoice in the system. The invoice must be resent with same invoice number without CopyIndicator.